In a setback for Mass., health care costs spike in state

4.8% rise tied to plan for poor, drug prices

By Priyanka Dayal McCluskey, Globe Staff

September 02, 2015 - The Boston Globe

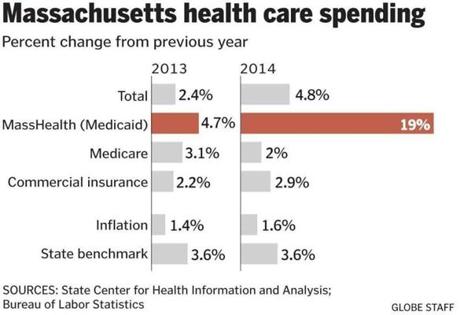

The soaring costs of insuring the state’s poorest residents drove health care spending in Massachusetts up 4.8 percent last year, double the rate of growth in 2013, dealing a setback to the state’s efforts to contain medical costs.

The increase far exceeds inflation, which was 1.6 percent last year, and blows past a state goal of holding health care spending growth to 3.6 percent annually, according to a report to be issued Wednesday by the state Center for Health Information and Analysis.

Health care spending rose 2.4 percent in 2013.

“It is terribly disappointing for all of us who have been working on health care cost control,” said Brian Rosman, research director of Health Care For All, a consumer advocacy group. “But I’m not sure if this is a temporary fluke or if we’ve strayed from the path.”

The report is the latest example of the challenges of bringing health care costs under control as state and federal laws expand access to medical services, expensive new drugs hit the market, and the population ages, analysts said. The federal government projects that per capita spending on health care will rise 4.9 percent a year nationally through 2024.

In Massachusetts, the growth in costs had slowed over the past few years but recently has begun to accelerate. Last month, state regulators approved an average health premium increase of more than 6 percent next year for small business and individual policies, triple the increase of 2014.

The new state report shows that last year’s spending increase was concentrated in the state’s Medicaid program, known as MassHealth, where spending surged 19 percent after rising less than 5 percent in 2013. MassHealth, funded by taxpayers, provides insurance to 1.8 million low-income residents.

The federal Affordable Care Act extended the program to cover a bigger share of the population, but MassHealth numbers also ballooned in 2014 when the state’s online insurance exchange crashed. About 300,000 were placed in the program temporarily, regardless of their income, as state officials sorted out problems with the exchange, called the Health Connector, according to the state report.

Also, the state in 2014 stopped checking whether members of MassHealth were eligible for the program, a process known as redetermination.

“It is tremendously concerning that we pay for so much health care for people who are turning out to not be eligible for the program,” said Joshua Archambault, a senior fellow on health care policy at the Pioneer Institute, a Boston think tank.

Governor Charlie Baker’s administration has resumed the redetermination process this year and so far has removed 205,000 people who were not eligible for MassHealth, saving about $250 million. The state budget limits MassHealth spending growth to 6 percent this year, said Billy Pitman, a Baker spokesman.

“Governor Baker is addressing the inherited problems at the Health Connector and continues to implement the redetermination process, ensuring the long-term sustainability of MassHealth to provide care for the Commonwealth’s most vulnerable,” Pitman said.

Analysts said they don’t know whether the spike in MassHealth spending was a blip or the beginning of a trend.

“We’re going to need to dig deeper,” said Stuart Altman, chairman of the Health Policy Commission, the state agency that monitors costs.

“If it’s the result of a temporary growth in enrollment, if it’s the result of more structural issues — at this point, we just don’t know.”

Overall health spending jumped to $54 billion statewide in 2014, from $51.3 billion a year earlier.

For Massachusetts residents on Medicare, the government health insurance program for seniors, spending rose 2 percent. For those in commercial health plans, which cover the majority of residents, spending grew 2.9 percent.

But beneath those modest increases is a concerning trend: Spending on drugs increased 13 percent.

“There are preliminary indications that costs are growing,” Altman said. “There are new drugs coming on the market that are very expensive, and new technologies. There are a number of factors that generate higher spending.”

The report also found that more people are enrolling in high-deductible health plans, which have lower premiums but require members to pay as much as thousands more dollars out of pocket when they use medical services.

Nineteen percent of Massachusetts residents with commercial insurance were enrolled in high-deductible plans last year, compared with 14 percent in 2012. Such plans can put a greater burden of health care costs on consumers.

“There is growing concern about the size of people’s financial exposure with high-deductible plans,” said John E. McDonough, a professor at the Harvard T. H. Chan School of Public Health. “Clearly, it discourages people from getting unnecessary care. It also discourages people from getting necessary care.”

In another shift, the report showed insurers continue to adopt alternative payment models, which are designed to give health care providers incentives to keep people healthy and out of hospitals — and ultimately contain costs.